Retiring young, while a dream for many, requires a strategic approach and a commitment to disciplined financial planning. Achieving early retirement involves more than luck; it demands careful consideration of your financial goals, disciplined saving and investing, and a willingness to make sacrifices in the short term for long-term gain. This article provides a comprehensive road-map for those aiming to retire early. IMPORTANT NOTE – I am not a financial planner. I am a teacher who was never taught anything about money growing up. If I was taught the things that I am about to share with you, I would be a whole lot closer to retirement than I am.

1. Define Your Retirement Goals

I remember when I was younger I used to always say, “I’m going to be a millionaire by the time I am 23.” Considering I was a college student working 2 jobs for mediocre pay, that wasn’t very realistic. Begin by setting clear and realistic retirement goals. Determine the age at which you want to retire and the kind of lifestyle you wish to maintain during retirement. Having a clear vision will guide your financial planning process. Notice that I said deciding what age you want to retire is part of the process. Many people default to “old” or “whenever social security kicks in. You do not need to be old to retire. The more that you plan ahead and the more that you are willing to sacrifice at a young age, the sooner you will be able to reach your retirement goals.

2. Craft a Comprehensive Financial Plan

Constructing a solid financial plan is essential. Estimate your future retirement expenses, considering factors such as living costs, healthcare, leisure activities, and potential unexpected expenses. Account for inflation to ensure your plan remains viable over time. There are a lot of factors that will impact how much money you need for retirement. The younger you retire, the more years you will hopefully be alive enjoying that retirement. That means you are going more years without income from your job. Imagine retiring at 40 and living to be 90. That means you would need to set up your retirement to last you 50 years.

Constructing a solid financial plan is essential. Estimate your future retirement expenses, considering factors such as living costs, healthcare, leisure activities, and potential unexpected expenses. Account for inflation to ensure your plan remains viable over time. There are a lot of factors that will impact how much money you need for retirement. The younger you retire, the more years you will hopefully be alive enjoying that retirement. That means you are going more years without income from your job. Imagine retiring at 40 and living to be 90. That means you would need to set up your retirement to last you 50 years.

3. Embrace Aggressive Saving

One of the cornerstones of early retirement is aggressive saving. Strive to save a substantial portion of your income—potentially as much as 50% or more. This requires a deliberate lifestyle adjustment that emphasizes frugality and disciplined spending. We will touch more on this in a minute. Most people think 50% sounds crazy, so start with something more manageable, such as 10% or 15%. Every little bit helps.

4. Invest Strategically

Investing wisely is crucial for growing your wealth over time. Construct a diversified investment portfolio that includes assets like stocks, bonds, real estate, and other investment vehicles. Tailor your investments to your risk tolerance and long-term goals. This is the step that I was always stuck on. Those things all sound great, but how? Like I said, nobody taught me about money growing up. I knew nothing about investing. We will get there.

5. Tackle High-Interest Debt

Paying off high-interest debt is paramount. Interest payments can significantly impact your savings, delaying your retirement plans. Prioritize eliminating high-interest debt to free up more funds for your retirement goals. Most people do not realize how much interest they are paying. Take the time to look at your credit card statement(s) and see how much interest you are paying. It may just make you sick. Get rid of it! The Bible says that the borrower is slave to the lender. You don’t need to be Christian to recognize that as the truth. This is why Dave Ramsey is so big on living a debt free life.

Paying off high-interest debt is paramount. Interest payments can significantly impact your savings, delaying your retirement plans. Prioritize eliminating high-interest debt to free up more funds for your retirement goals. Most people do not realize how much interest they are paying. Take the time to look at your credit card statement(s) and see how much interest you are paying. It may just make you sick. Get rid of it! The Bible says that the borrower is slave to the lender. You don’t need to be Christian to recognize that as the truth. This is why Dave Ramsey is so big on living a debt free life.

6. Seek Additional Income Streams

To accelerate your savings, explore opportunities for additional income. Whether through side gigs, freelancing, or starting a small business, diversifying your income sources can provide a significant boost to your retirement savings. There are so many opportunities out there to earn extra income. Some people will tell you to just look for whatever pays the most. My personal belief is that you will have more luck if you find something that interests you. Personally, I have been making side income as a Team Beachbody Coach for years now. Why? Because I have always been interested in fitness and thought it would be rewarding helping others live healthier lives. So, what are you interested in? Find something that is related that.

7. Embrace Frugality

Living below your means is key to achieving early retirement. Cultivate a frugal mindset and make conscious spending decisions. By cutting unnecessary expenses, you can allocate more funds toward your retirement goals. I can’t tell you how many times someone has complained about being broke to me when I know they are paying for multiple streaming services, ESPN packages, cable, etc. I am not saying that you can’t enjoy life. However, think about what you want long term. Every penny that you can put toward your future will help you reach your goals that much sooner.

Living below your means is key to achieving early retirement. Cultivate a frugal mindset and make conscious spending decisions. By cutting unnecessary expenses, you can allocate more funds toward your retirement goals. I can’t tell you how many times someone has complained about being broke to me when I know they are paying for multiple streaming services, ESPN packages, cable, etc. I am not saying that you can’t enjoy life. However, think about what you want long term. Every penny that you can put toward your future will help you reach your goals that much sooner.

8. Invest in Skill Development

Investing in your education and skill development can lead to higher-paying opportunities. Continual learning equips you with the tools to secure better income over time, facilitating your early retirement objectives. Instead of scrolling through whatever it is you like to scroll through, invest your time into learning. The greatest invest that you can make is into your own development. As you become a better you, you increase your value.

9. Optimize Tax Efficiency

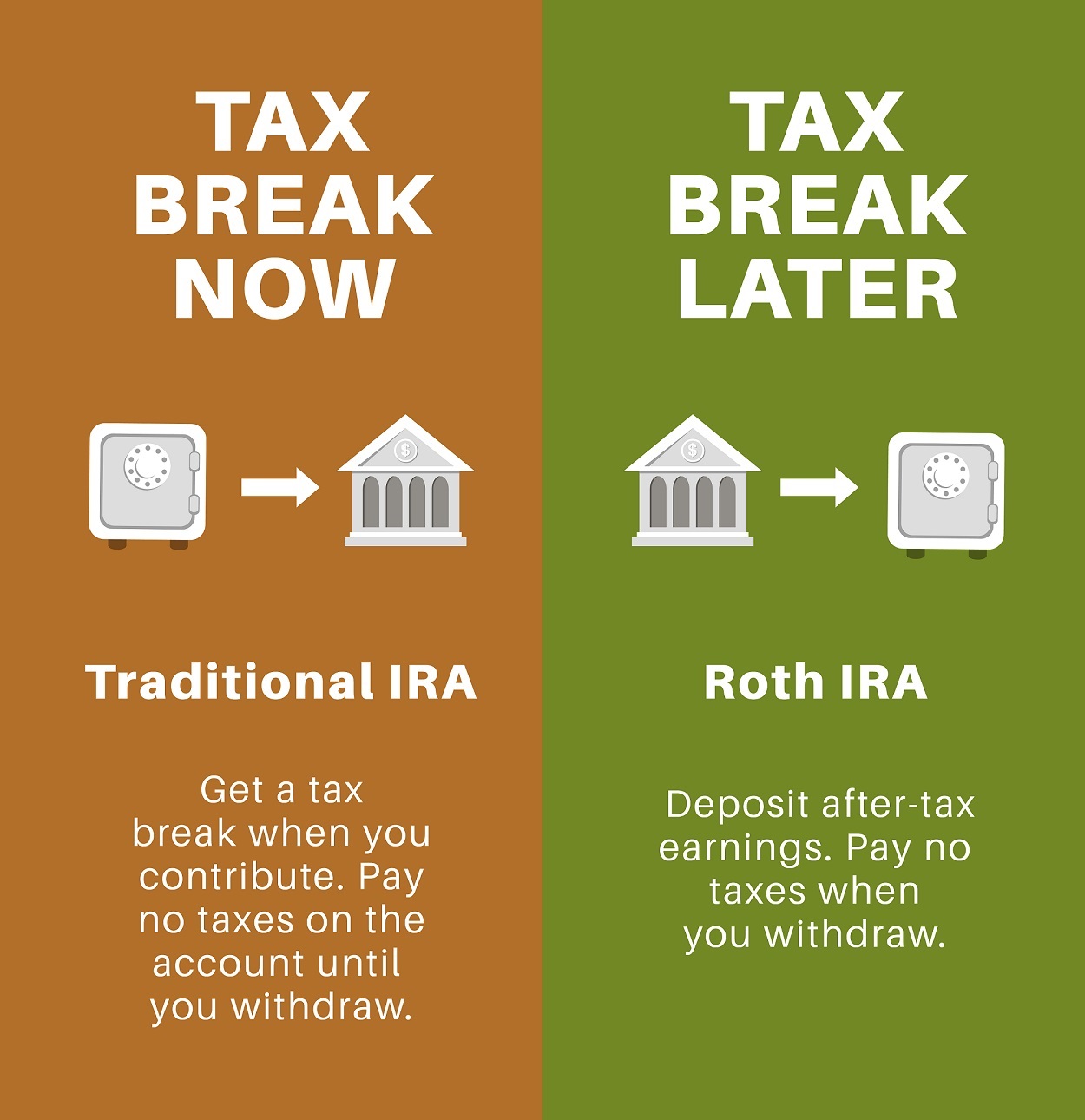

Understanding tax laws and leveraging tax-efficient investing strategies can minimize your tax burden. Explore retirement account options like IRAs and 401(k)s to maximize your tax benefits. I suggest checking out THIS ARTICLE on the difference between IRAs and Roth IRAs.

10. Plan for Healthcare Costs

Healthcare expenses can be significant in retirement. Ensure you have a solid healthcare plan in place and consider utilizing Health Savings Accounts (HSAs) to cover medical costs. As someone with an interest in fitness, my suggestion is to focus on your health now. It is a lot harder to get started when you are older. It kills me seeing people taking 5, 10, even more medications. While I know that there are situations that are out of our control that occur, why not prevent the ones that you can by being proactive with your health?

11. Establish an Emergency Fund

Maintaining an emergency fund safeguards your retirement savings from unexpected expenses. Having a financial cushion ensures that your retirement plans remain on track, even in challenging times. A common question here is, “how much should I save?” Personally, I think Dave Ramsey has the right idea. He says that you should have a 3 – 6 month emergency fund. So, if your monthly expenses total $4,000, you should save $12,000 to $24,000. Of course that is after you are debt free (minus your mortgage). I highly suggest reading Dave Ramsey’s Books to learn more about setting yourself up for retirement.

12. Cultivate Multiple Income Sources

Diversify your retirement income sources. Consider rental income, dividends, and part-time work to ensure a steady stream of funds during retirement, reducing the risk of outliving your savings. Every smart investor that I know stresses the importance of diversification. Don’t take advise lightly. I remember several years ago talking to a neighbor. He was telling how financially secure he was in the early 2000’s. He had a lot of money, but it was all invested in real estate. When the housing bubble busted, he lost everything. More recently I have seen the same thing done with crypto. Do not put all of your eggs in one basket, no matter how great someone tells you that basket is.

13. Regularly Review and Adjust

Periodically revisit and adjust your retirement plan as circumstances evolve. Monitor your investments, adapt to shifts in goals, and make necessary adjustments to your financial strategy. Life happens. When something changes, regroup, reevaluate, and continue working toward your goals.

14. Adopt a Long-Term Mindset

Recognize that early retirement necessitates a long-term perspective. Be prepared for sacrifices and delayed gratification in the short term to attain your long-term goals. This is so incredibly difficult for most people. They have the, “I want to enjoy life now” mindset, thinking that in order to do that they need to spend lots of money. I remember talking to one of my students last year. I teach high school, and one of my students was telling me about the hemi that he just bought for his jeep. While he was waiting for the engine to come in, he was working on the speaker system he was installing. The amount io money that he was investing into his Jeep was incredible. All I was thinking was that if he put that money into a conservative investment account at his age, it would practically set him up for retirement. What is your weakness? What is it that you have trouble giving up now that is draining your wallet, even though you know it is not a smart move? Eating out? Fancy clothes? Partying? Cars? Nobody is saying that you cannot enjoy life and still prepare to retire young. This is where planning comes into play. If you have selected how much you are going to save/invest each month, work with what you have left over and enjoy yourself.

15. Consult Professionals

Seek guidance from financial planners, investment advisors, and tax professionals to ensure your early retirement strategy is well-informed and aligned with your objectives. When in doubt, ask a professional. There are a ton of them out there, so make sure that you do some research and find one with a good reputation.

Conclusion

Retiring young is an achievable goal with a well-thought-out plan and disciplined execution. By setting clear goals, aggressively saving, investing strategically, and embracing a frugal mindset, you can pave the way for a financially secure and fulfilling retirement. Remember that early retirement requires careful planning, commitment, and adaptability as you navigate the path to financial independence.

Recent Comments