Individual Retirement Accounts (IRAs) are powerful tools for securing your financial future. They come in two main flavors: Traditional IRAs and Roth IRAs. Understanding the differences between these two types of accounts is essential in making the right choice for your retirement savings strategy. This article delves into the key distinctions between Traditional IRAs and Roth IRAs to help you make an informed decision. Note – I am not a financial advisor. I am just a teacher trying to pass on what I have learned so that you don’t make the same mistakes that I made.

Traditional IRAs: A Snapshot

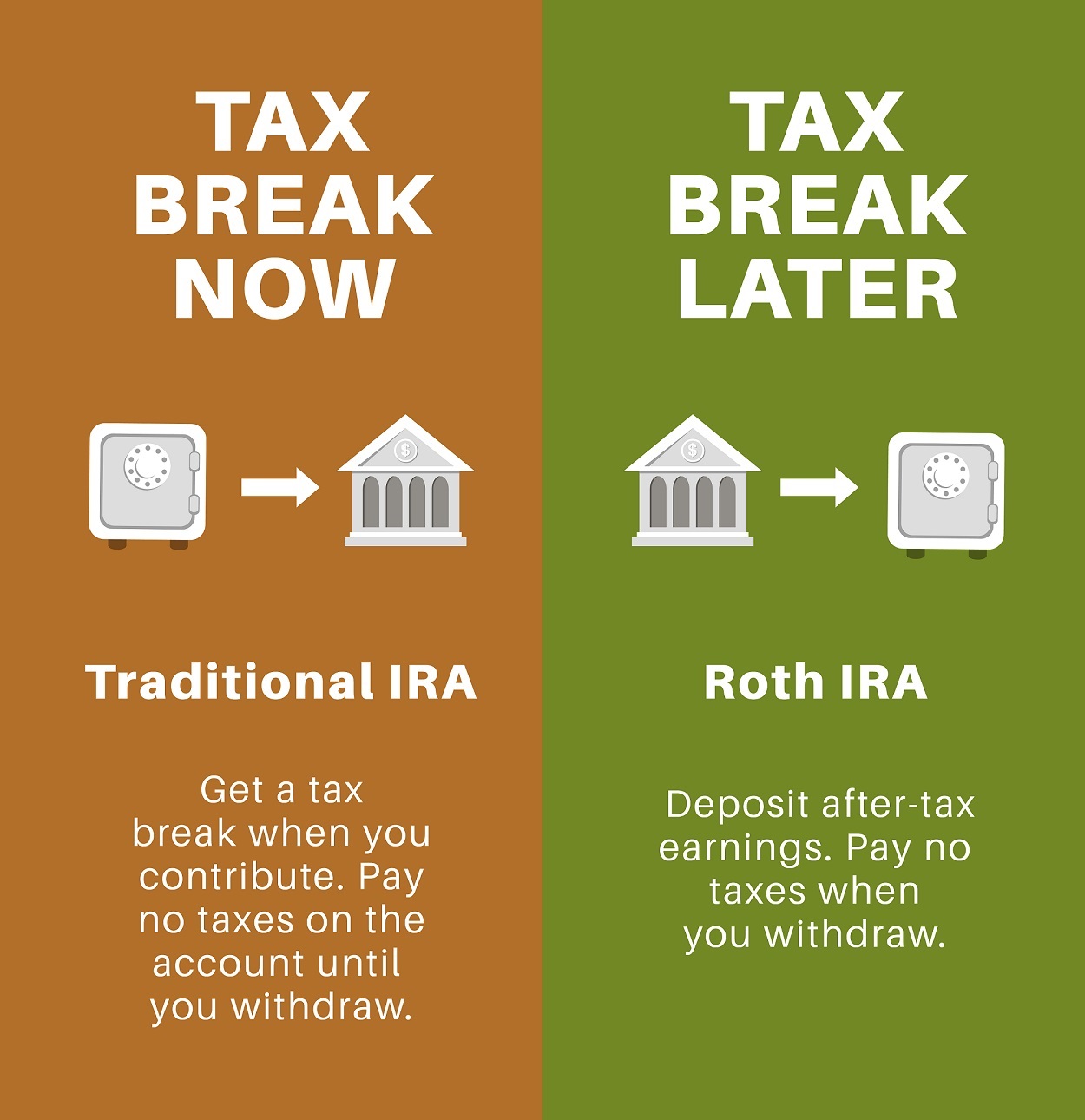

A Traditional IRA is a retirement account that offers potential tax benefits today, but defers taxes until you withdraw the funds in retirement. Here’s a closer look at the key features of a Traditional IRA:

- Tax Deductible Contributions: Contributions to a Traditional IRA may be tax-deductible, reducing your taxable income for the year you make the contribution. This can lead to immediate tax savings.

- Tax-Deferred Growth: Any earnings on investments within the Traditional IRA grow tax-deferred until you withdraw the funds in retirement. However, withdrawals are taxed as ordinary income.

- Required Minimum Distributions (RMDs): Once you reach age 72 (formerly 70½), you’re required to start taking minimum distributions from your Traditional IRA, whether you need the money or not. These withdrawals are subject to income tax.

Roth IRAs: A Closer Look

A Roth IRA offers a different approach, allowing you to pay taxes on contributions upfront but enjoy tax-free growth and withdrawals later. Here’s what sets Roth IRAs apart:

- Tax-Free Qualified Withdrawals: One of the most significant advantages of a Roth IRA is that qualified withdrawals—those made after age 59½ and the account has been open for at least five years—are entirely tax-free. This includes both your contributions and any earnings.

- Non-Tax-Deductible Contributions: Roth IRA contributions are made with after-tax dollars, meaning you don’t get an immediate tax deduction. However, this allows your contributions to grow tax-free.

- No RMDs: Unlike Traditional IRAs, Roth IRAs don’t have required minimum distributions (RMDs). This provides flexibility in managing your retirement income.

Comparing the Two: Factors to Consider

- Tax Considerations: Your current and future tax situation is a critical factor. If you expect your tax rate to be higher in retirement, a Roth IRA’s tax-free withdrawals might be more appealing. If you want immediate tax benefits, a Traditional IRA could be a better fit.

- Income Limits: Roth IRAs have income limits that determine eligibility for contributions. Traditional IRAs have no income limits for contributions, but income can impact the deductibility of your contributions.

- Long-Term Goals: Assess your long-term financial goals. If you want to maximize your contributions now and deal with taxes later, a Traditional IRA might align better. If you’re seeking tax-free income in retirement, a Roth IRA could be more suitable.

- Estate Planning: Roth IRAs offer more flexibility for passing on assets to heirs. Beneficiaries of Roth IRAs inherit the funds tax-free.

- Flexibility: Roth IRAs allow you to withdraw your original contributions (but not earnings) at any time without penalty, providing a degree of flexibility.

Conclusion

Choosing between a Traditional IRA and a Roth IRA requires a deep understanding of your financial circumstances and goals. Traditional IRAs offer immediate tax benefits but tax the withdrawals, while Roth IRAs forgo tax deductions upfront in exchange for tax-free withdrawals. Your current and future tax situation, retirement goals, and financial flexibility should guide your decision. Consulting a financial advisor can provide personalized guidance, ensuring your choice aligns with your unique needs. Regardless of your choice, taking advantage of an IRA is a step toward a more secure retirement future.

Recent Comments